In case you are wondering what happens after blocking a transaction on Chime. Then you are at the right place, as in this blog we will discuss ‘What Happens When You Block Transactions On Chime?’. Chime is a financial technology company in America. It allows free-of-cost mobile and internet banking services. The Bancorp Bank or Central National Bank is the owner of Chime.

Chime provides a service for sending and receiving the money to friends and family. You will be able to receive your paycheck up to 2 days early through this. Additionally, there is an option of over-drafting up to $200 without paying any fee. After opening an account with Chime, you will get a Visa debit card, a saving account, and a spending account. The debit cards of Chime work worldwide but now we have to find out the aftermath of blocking transactions on Chime.

Also Read: How To Check Chime Pending Deposits?

What Happens When You Block Transactions On Chime?

When You Block Transactions On Chime then every transaction made by your debit card directly or its number will stop. You have to enable it again for it to work. But you will be able to receive money still on your account.

Does blocking transactions on Chime will block my direct deposits too?

Yes even after blocking transactions on Chime, you will be able to receive your direct deposits in your account. Blocking transactions can only stop those transactions that you make using your debit card. So, your direct deposits will not be stopped nor any other debts that may be set with your routing and account number.

When your debit card is lost or stolen then you have the option to block the transactions to prevent such transactions. Then, you don’t have to worry about it and you will still receive your deposits. After doing so, you can easily order a new Chime debit card.

How to Block Transactions On Chime?

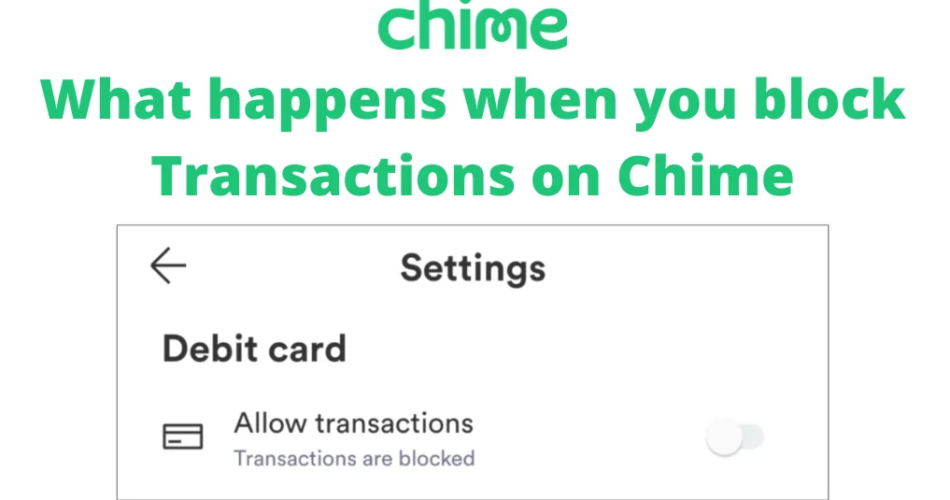

As we have already discussed What Happens When You Block Transactions On Chime? So, now let’s move on to the procedure of blocking transactions on Chime. You can do so from the Chime mobile app or website.

On the app-

- Firstly, navigate to Settings.

- Secondly, search and scroll to that card you wish to block.

- Thirdly, you have to allow transactions by setting the toggle to the off position.

On www.chime.com-

- Firstly, you have to sign in by entering the credentials.

- Secondly, click on your name available in the upper right corner. Then, click on Settings.

- Thirdly, Scroll down to Password & Security.

- Lastly, you have to set the toggle to the off position that is available next to Chime Card Transactions.

How To Replace Your Chime Debit Card?

If you are in need of a replacement after your Chime debit card got lost or stolen. Then, you can request it by following the steps given below. But before that, please ensure that your mailing address is up-to-date. You can do so by going to Settings > Personal Information.

- Firstly, navigate to Settings.

- Secondly, search for the card you want to replace by scrolling down.

- Lastly, click on Replace your Card then keep following the prompts.

Now you will receive your replacement Chime card in 7 to 10 business days. In this way, you will be able to deactivate your previous card. Additionally, Chime provides a feature that will give you access to a temporary digital card in Settings until your replacement arrives. So, we hope that after learning ‘What Happens When You Block Transactions On Chime?’, you can follow this process.

Conclusion

We hope that our blog on ‘What Happens When You Block Transactions On Chime?’ has solved all your queries. You can follow the above procedures to block transactions and get a replacement Chime card. However, you should note that if you request a replacement because of damages then it will be active until you receive your new card and it activates.