In today’s world, people are using digital transactions at a rapid pace. With this, there is also an increasing need to protect the sensitive account data of users; while they move through various online and offline payment portals. In this article, we take a look at Visa Provisioning Service; and also learn what it is, how it works, and also whether it is safe for you or not.

Visa Provisioning Service — How does it work?

The service is essentially the activation of mobile payments on your smartphone via NFC. Network operators, financial institutions, and transit agencies are already using this payment method; to link VISA payment accounts to users’ smartphones.

Consumers can download an app on their phone; then ask their financial institution to activate these mobile payments on their devices. The Visa Provisioning Service, also known as VPS, authenticates the user’s account with a secure passcode; to exchange secure “keys” that unlock the NFC chip in the phone, activate the service; also download the payment account information locally to the device.

The above method is tokenization; as it replaces the user’s account number with a token generated by the company to protect the user’s sensitive data. The entire process is as follows:

- You register your VISA account with a payment service by entering the relevant account details; such as account number, security code and any other required information.

- VISA is then contacted by your service provider and requested for a payment token for your just registered account.

- Thereafter, VISA will forward the token request to your account holder. Most likely your bank.

- Once the account holder approves the request, VISA will replace your primary account number with the token.

- This token will now be assigned to your transactions and will be passed in place of your actual account number; each time you make a payment.

What is this $0 fee on my account?

If you see a Visa Provisioning Service fee or pending purchase authorization on your account or statement; you can usually assume it is a secure transaction if you have registered your card; with an online merchant, digital wallet provider, or any payment service.

A Visa Provisioning Service fee should show as zero ($0) on your account. It is a tokenization process that many merchants use to protect your sensitive account data and information. Also, it’s especially popular with merchants using e-wallet services and online merchants. It helps shorten transaction times. This fee is typically deducted from your account within one week.

What is the Visa Provisioning Service Fee?

Many people will be concerned by this fee on their statement transaction history. When you first see this fee, you will probably wonder why it is there. This fee is basically a type of pre-authorization by a retailer or digital wallet operator you have done business with. Thus, as discussed above it is a way to verify whether or not the account is valid.

The merchants want to make sure that your payment method is valid before they approve your transaction. The fee is one way to verify this upfront. You may see a Visa Provisioning Charge when shopping online or making in-app purchases; as well as when making in-store purchases with your connected device.

Some direct deposit companies also use the Visa Provisioning Service fee. It is to ensure that your account is authentic and valid for depositing your money. This may also be the case if you write a cheque for encashing recently.

Some more examples when this fee is there are; adding a debit card to a digital wallet – such as Apple Pay or other services. It often results in the digital payment provider checking the account to make sure it’s active.

Note that, more and more online merchants are now using the tokenization process; to make transactions instead of processing your account information.

How does VPS work? –> The Tokenizing Process

Tokenization is a technique that comes in use to protect your account details and your credit card; from illegal access and unauthorized purchases. This whole system is what we know as the Visa Token Service System.

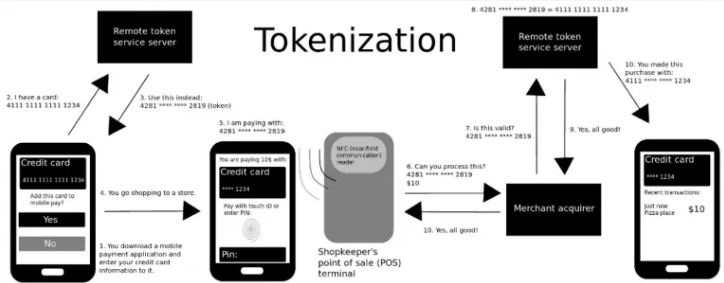

It is this thing that generates the $0 fees you see on your transaction statement. In fact, it ensures that your account number is not compromised when you make a purchase. A unique identifier (the token) replaces your usual 16-digit credit card number.

Note that this token process allows merchants to process your payment without revealing your account information. The constant increasing and voluminous payments increase the need for a good tokenization service.

Also, as payments are increasing by the day, using connected devices, this system is becoming more important. Cardless or cardless payments require tokenization to enable frictionless, secure digital transactions.

Tokenization and its working

- You enroll your Visa card with a digital payment service; this requires you to enter your account number, expiration date, CVC, and other personal information. It can also be a digital wallet.

- The digital payment service contacts Visa to obtain a payment token; that will be linked to the account you registered on the service’s website.

- Visa then shares your token with your account issuer (usually your bank).

- Once the issuer or bank approves the application; Visa uses the token (an unique identifier) to replace your primary account number.

- The token is assigned to your purchases and notified to the merchant by Visa. This token is unique and assigned only to you, but not necessarily permanent.

Here is an article on the Size of Bitcoin Blockchain !!

Using tokens

Tokens are important for protecting your account information during online transactions and are suitable for a variety of scenarios. Whether you make a purchase online, in a store using your mobile device, or in an app; there is a good chance that the Visa Provisioning Charge will show up in your transaction history.

If you are using the tokenization system, here is how you proceed:

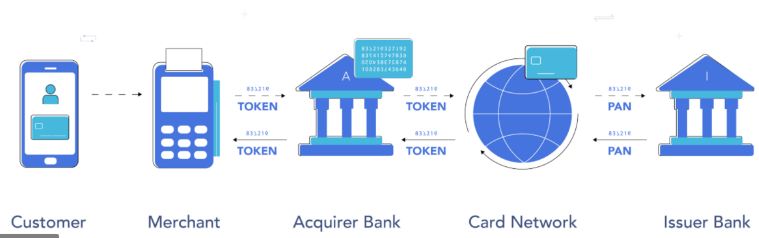

- You initiate the payment (online, in a store, or inan app).

- The payment processor – either the online merchant or the e-wallet – passes the token to the acquirer or merchant. This is an essential part of the authorization request.

- The acquirer takes the token received and sends it back to the Visa network. In this way, the purchase transaction can be completed.

- Visa then forwards the token and card payment information to the card issuer; usually your bank, to authorize the transaction.

- The bank then accepts or declines the transaction before sending that decision back to Visa.

- The merchant then receives the payment and the token.

WRAPPING UP !!

In this post, we have acquired knowledge of the Visa Provisioning Service. What it is? How does it work? We also learned about Tokenization and the Visa Token Service. Also how it works? With that, on a parting note, in anticipation that you take something valuable from here; I take your leave. Until next time, see ya !! Goodbye !! :)~